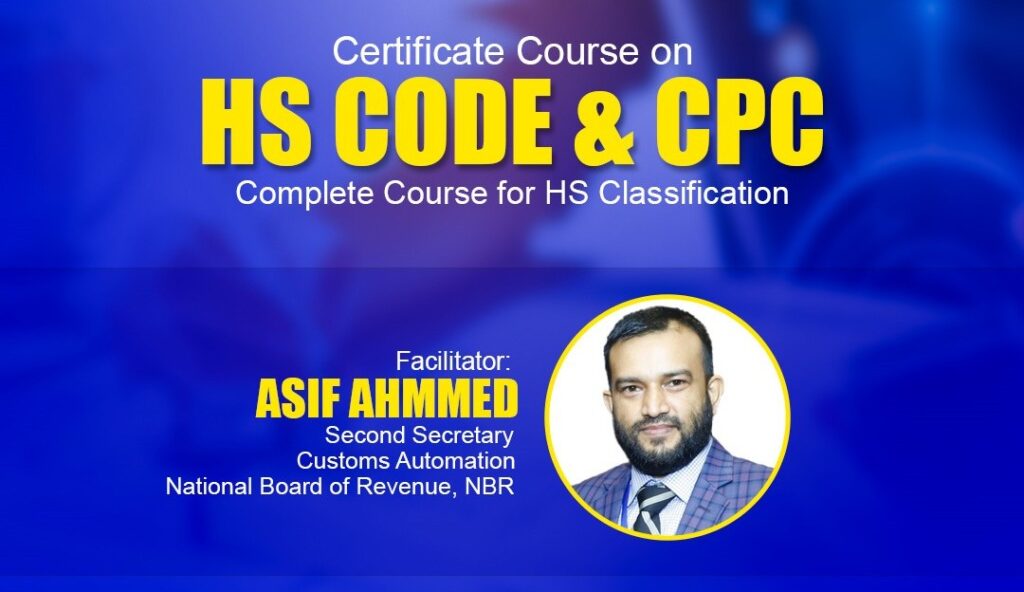

Professional Certificate Course in

HS CODE & CPC

With Renowned Faclilitators

From National Board of Revenue (NBR)

Course Length

2 months

Class Duration

2.5 hours

Total Class

06 session

Starting From

01 Dec, 2025

Classes on

Friday & Saturday

Class Time

08:00 - 10:30pm

Class Type

Online

Platform

Zoom

Course Module

Key Highlight

- Basic Discussion & General Rules for the Interpretation

- Dash Classification, Using by Dash

- HS Code Switching

- Section Note, Chapter Note

- Functional Composite, Machine Classification

- Practical Session

In today’s global trade environment, accurate product classification under HS Code (Harmonized System) and CPC (Customs Procedure Code) is essential for ensuring compliance with customs regulations and avoiding costly trade delays.

This comprehensive 6-session Certificate Course is designed to provide participants with a clear, practical understanding of HS Code & CPC classification and its applications in international trade and customs procedures.

Guided by experienced customs officials and practitioners, the course covers every aspect—from General Rules of Interpretation (GRI) to Section & Chapter Notes, Dash Classification, and Machine Classification—ensuring participants gain both conceptual clarity and practical competence.

Whether you are an importer, exporter, customs agent, or tax professional, this program will help you enhance your skills and confidence in handling customs documentation, tariff classification, and compliance more effectively.

After completing this course, participants will be able to:

Understand the concept and structure of HS Code & CPC used in customs procedures.

Apply the General Rules for Interpretation (GRI) effectively during classification.

Learn Dash Classification techniques and proper use of sub-headings.

Identify and analyze Section Notes and Chapter Notes to ensure correct classification.

Master Functional Composite and Machine Classification methods.

Gain hands-on knowledge through practical case-based sessions.

This course is ideal for:

Importers, Exporters, and Freight Forwarders who deal with customs documentation.

Professionals involved in international trade, logistics, or supply chain management.

VAT, Tax, and Customs practitioners who want to enhance their understanding of HS Code & CPC.

Business owners and compliance officers responsible for customs declarations.

Students and graduates seeking a career in customs, trade, or taxation.

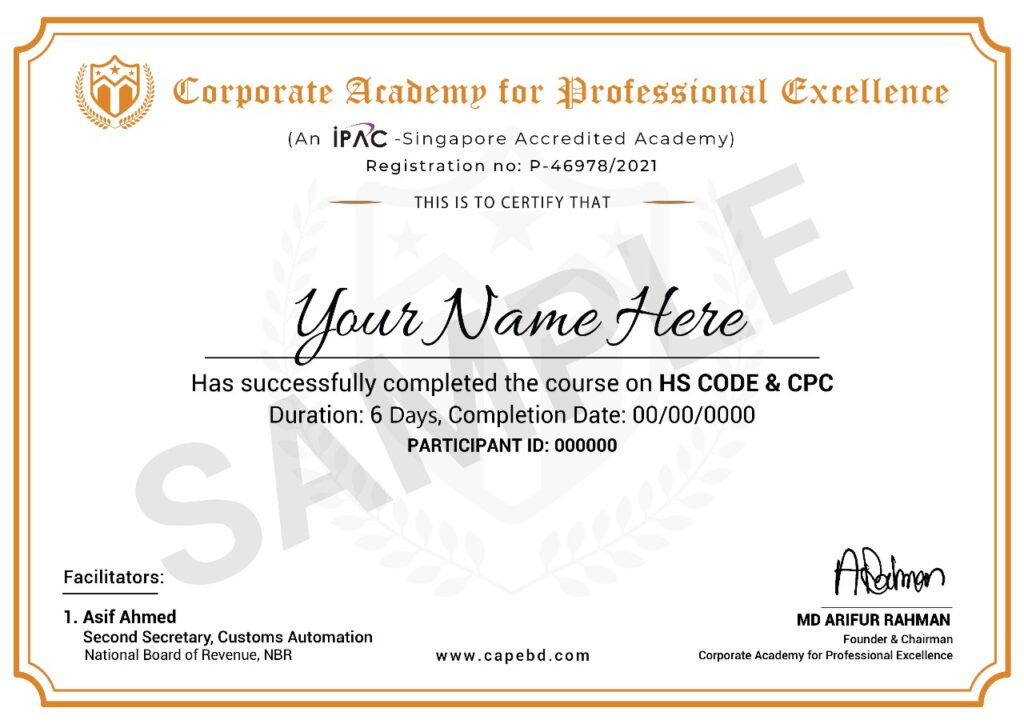

- After successfull completion of this course, you will get a certificate.

FAQ

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

To get the PGD certification after successful completion of the course.

Clarify Your Skills

Basic skills must be demonstrated for certification.

Notice Your Attendance

Minimum attendance is required to qualify.

Industry Expart Trainer

Organizations We Work With