Professional Certificate Course in

INCOME TAX MANAGEMENT

With Renowned Faclilitators

From National Board of Revenue (NBR)

Course Length

2 months

Class Duration

2.5 hours

Total Class

12 session

Starting From

20 October, 2025

Classes on

Friday & Saturday

Class Time

08:00 - 10:30pm

Class Type

Online

Platform

Zoom

Course Module

Topics at a glance:

1: Direct Tax Structure in Bangladesh.

2: Sources of Income Tax Law and Practices in Bangladesh.

3: Basic concepts of Income Tax, Definition of Taxes term.

4: Concept of Income from Employment.

5: Concept of Income from Rent.

6: Concept of Income from Agriculture.

Topics at a glance:

1: Concept of Income from Rent.

2: Concept of Income from Business.

3: Concept of Income from Capital Gain

4: Concept of Income from Financial Asset.

5: Concept of Income from other Sources.

6: Concept of Firm Income, Tax Rebate.

Topics at a glance:

1: Compliance Requirements for TDS.

2: Reference Sections and Rules for TDS (sections 86-139)

3: Detailed discussion on TDS from Contractor or Supplier

4: Preparation of Monthly TDS Return

5: Timeframe, and Procedure for TDS Deposit

6: Return Preparation in Case of Minimum Tax Rate Applicable Income

A) Calculation of Income (differrent heads of Income)

1: Salary

2: Income from house property

3: Agricultural Income

4: Income from business/profession

5: Capital gain

6: Income from financial assets

7: Income from other sources

B) Special areas of income from other sources

C) Income from Partnerhsip/Firm

D) Rebate & Investment allowance

E) Advance income tax and interest on AIT

Advance income tax and interest on AIT

Individual Tax Calcualtion & Return Preparation (complex case study)

1: Introduction to Return, IT-10B, IT-10BB & all schedules (excel copy)

2: Discussion and reviewing on real case senerio on personal return

3: Preparation of various statement, schedule to backup IT-10B

4: Case Study-2 ( practical case solution and return preparation by students)

5: Review and discussion on case study-2

6: Return submission (hard copy)

7: Online Return Submission Process

1: Tax Assessment (Sec: 180,181,183-185,189-196)

2: Audit (Sec: 182)

1: Set off and carry forward of losses

2: Types of Returns of Income

3: Assessment Procedure

4: Self-Assessment

5: Normal Assessment

6: Assessment of Concealment

7: Discussion on Different Types of Assessment.

1: Appeal (Sec: 285-308)

2: Tribunal

3: Reference at High Court Division

4: Alternative Dispute Desolution, ADR

Case Study-1 (Calculation covered below sections related to company tax)

1) Know your Chart of Accounts

2) Introduction of financial statement & audit report (based on real report)

3) Pre-audit work on financial statements as a tax adviser

4) Reconciliation of TDS & VDS based on the financial statement

5) Reconciliation of credit transactions of company's all bank accounts in

line with sales

6) Reconciliation of revenue VS TDS deducted by customers

7) Special areas of income from other sources

8) Calculation of depreciation (accounting vs tax law) and carry forward

9) Deal with the circle and tax authority for normal assessment

Company Tax Calculation & Return Preparation (complex case study)

1) Discussion and reviewing on real case scenario on company return

2) Case Study ( practical case solution will covered following areas )

2.1: Segregation of Incomes, which will be considered separately

2.2: Segregation of authorized expenses will be considered separately

2.3: Calculation of special Business Income as per section 46

2.4: Segregation of unauthorized expenses as per section 55

2.5: Calculation of authorised expenses

2.6: Calculation of special business income

2.7: Application of minimum tax and distribution of income

2.8: Calculation of tax liabilities & AIT adjustment

2.9: Adjustment and carry forward of losses

3) Review and discussion on case study

4) Documentation and return submission

In today’s regulatory and business environment, a strong understanding of VAT and income tax laws is critical for businesses, professionals, and individuals looking to ensure compliance and optimize nancial operations.

This 2-month, 12-session certifcate course is carefully designed to equip participants with the complete work ow of VAT & Tax management in Bangladesh, directly guided by senior o cials from the NBR.

Whether you’re a nance professional, entrepreneur, or VAT/Tax Professional, this course will empower you with practical skills and insights to handle VAT & Tax matters e ciently and condently.

You will gain complete practical knowledge of Income Tax Management in Bangladesh, including both individual and company taxation.

Key learning outcomes:

- Fundamentals of Income Tax: Legal frameworks, definitions, tax rates, and sources of income.

- Computation of Income: From salary, rent, agriculture, business, capital gains, and financial assets.

- TDS & TCS: Law, compliance, monthly return filing, and minimum tax application.

- Individual Tax Management: Calculation, rebate, investment allowance, and online return submission.

- Assessment & Audit: Procedures under relevant sections, self-assessment, and normal assessment.

- Loss & Penalty Management: Set-off, carry-forward, and concealment assessment.

- Appeals & Dispute Resolution: Appeal tribunal, reference at High Court, and ADR processes.

- Company Tax Management:

- Reconciliation of financial statements and TDS/VDS.

- Case-based company return preparation.

- Calculation of depreciation, authorized expenses, special business income, and minimum tax.

- You’ll also work on real-life case studies guided by senior NBR officials.

This course is ideal for:

Finance professionals (working in accounting or taxation).

Entrepreneurs and business owners managing tax compliance.

Students and graduates in accounting, finance, or business who want to start a tax consultancy career.

Tax practitioners and consultants who want to update or strengthen their practical knowledge.

Job seekers aiming for roles in audit firms, tax departments, or financial management.

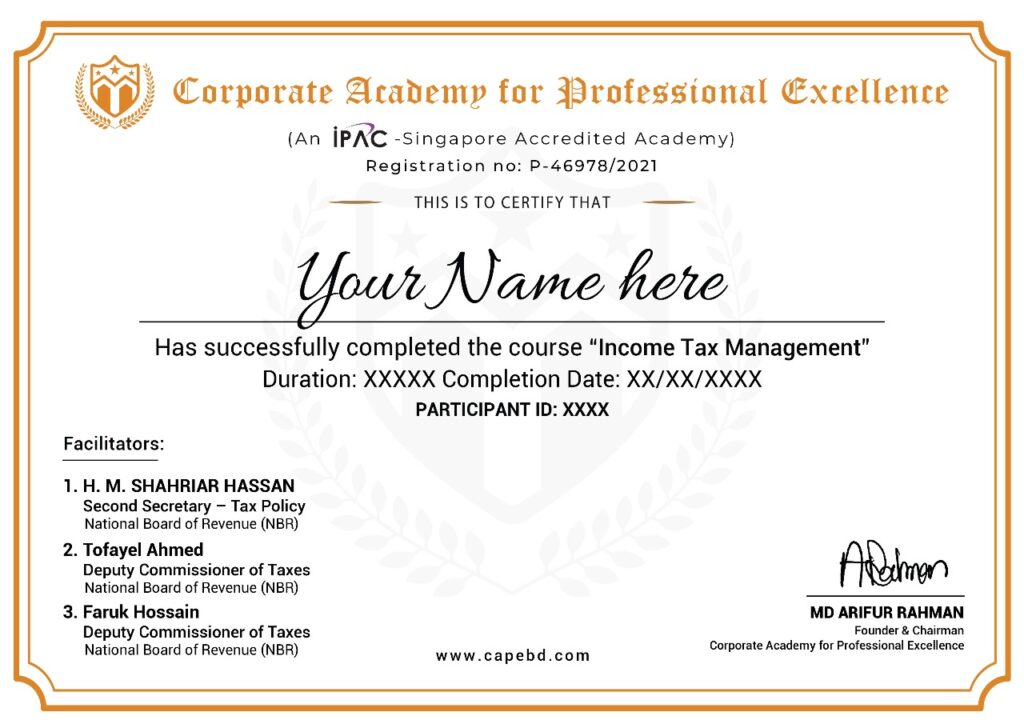

- After successfull completion of this course, you will get a certificate.

FAQ

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

To get the PGD certification after successful completion of the course.

Clarify Your Skills

Basic skills must be demonstrated for certification.

Notice Your Attendance

Minimum attendance is required to qualify.

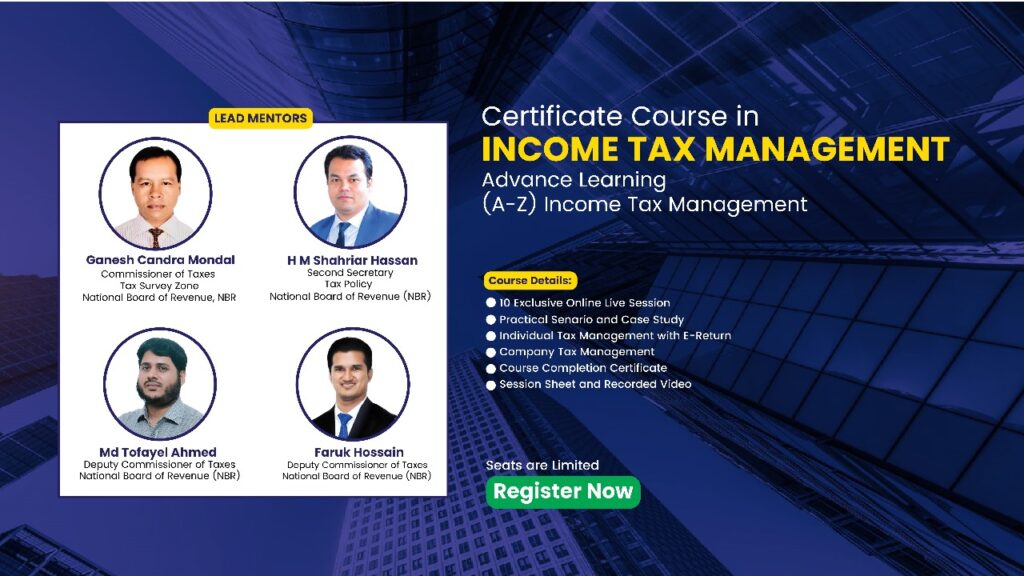

Industry Expart Trainers

Ganesh Candra Mondal

Commissioner of Taxes Tax Survey Zone

National Board of Revenue (NBR)

H M Shahriar Hassan

Second Secretary – Tax Policy

National Board of Revenue (NBR)

Faruk Hossain

Deputy Commissioner of Taxes

National Board of Revenue (NBR)

Tofayel Ahmed

Deputy Commissioner of Taxes

National Board of Revenue (NBR)

Organizations We Work With