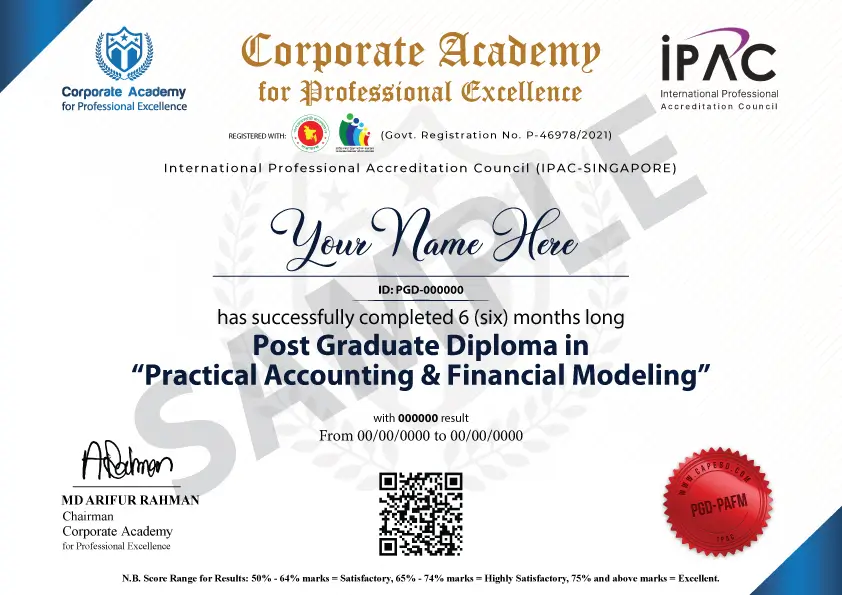

আমদানি-রপ্তানি বাণিজ্য বিষয়ক ডিপ্লোমা কোর্স

PGD-EIB

35,500 Tk 38,500 Tk

Limited Time Offer!!

If you want to join this course, register before the offer ends.

কোর্সটি মূলত আমদানি রপ্তানি বানিজ্যের ধারাবাহিক (স্টেপ বাই স্টেপ) কার্যক্রমের উপর পূর্নাঙ্গ একটি গাইডলাইন

Course Module

Key Highlight

- Accounting concept & framework Incl. IAS & IFRS.

- Accounting software-Tally (Step by step accounting transactions practical session).

- Analysis & reporting using advanced Excel to make yourwork life easy.

- Necessary excel formulas for accounts department & Different Financial Modelling.

- Preparation of Financial Statement and performance analysis for better business decisions.

- Financial statement analysis for VAT & Income tax professionals for NBR audit preparedness.

- Product Costing & pricing techniques, Landed cost and Inventory valuation.

Class 01: Understanding Basic Accounting Concepts

Class 02: Books of accounts, Bank Reconciliation and Journal Entries of Rectification of Error

Class 03: Accounting Standards- IAS & IFRS

Class 04: Preparation and Presentation of Financial Statement

Class 05: Cash flow statement (Direct & Indirect Method)

Class 06: Cost Accounting: (IAS 2) Measurement of Inventory, Inventory Valuation, write off, disclosure in FS, Landed cost & other cost analysis

Class 07: Cost Accounting: practical demonstration of product costing & pricing techniques, value chain analysis (How to calculate net realization value)

Class 08: Property, plant and Measurement as per IAS-16

Class 09: Revenue recognition & Lease accounting

Class 10: Accounting Terminologies for business performance analysis

Class 11: Current Tax & deferred Tax calculation & presentation in FS

Class 12: Review on Accounting cycle completion in a company

Class 13: Management Information System (Incl. BEP, EBITDA, NPAT, costing & necessary ratios for better business decision)

- Exam: Exam on practical accounting & finance operations

- Class 01: Accounting Software-How It Works?

a. Setup

b. Transaction/Posting

c. Reporting

(Tools: 1. Tally, 2. QuickBooks 3. miSoftware)

- Class 02: Tally Software:

1. Chart of accounts & mapping of transactions

2. Purchase & Payable Management

(Incl. PO, GRN, Invoice, TDS & VDS, payments process)

3. Sales & Receivable Management

(Incl. Sales order, Delivery challan, Sales Invoice, Sales collection)

- Class 03: Tally Software:

1. General Ledger: Ledger concept, Provision journal, Payable journal, standard journal

2. Financial Statement: Trial Balance, Financial Statemen, P&L, Equity

- Class 04: Misoftware

1. Chart of accounts & mapping of transactions

2. General accounting

3. Industries Specific Accounting (Trading, Hospital, NGO, Service, Manufacturing)

4. Purchase Process (Requestion to Pay)

- Class 05: Misoftware

1. General Ledger, Management Reporting, miOffice-HR & Payroll

2. Financial Statement: Trial Balance, Financial Statemen, P&L, Equity

- Class 06: QuickBooks Software

1. Software Overview

- Class 07: Financial Statements Preparation from accounting Software

1. Notes to the accounts

2. Trail Balance Export from Software

Exam on practical demonstration of Accounting Software

Class 01: Financial statement analysis for Income tax audit by NBR, preparedness & documents keeping for smooth audit Incl. TDS

Class 02: Input-out co-efficient preparation in excel with overhead allocation (Value addition)

Class 03: Financial statement analysis to face VAT audit conducted by NBR. Revenue recon with FS & VAT return, VDS analysis & keep documents ready for smooth audit.

Class 01: Advanced Formulas and Skills Required for Financial Modeling

Class 02: Financial Modeling Best Practice

Class 03: Building Multi Sheet Three Statement Model

Class 04: Building Single Sheet Three Statement Model

Class 05: Business Valuation & Discounted Cash Flow Model

Class 06: Scenario and Sensitivity Analysis

Class 07: Data Visualization

Class 08: Master Budget, Operational model, and Feasibility Report

- Exam

Exam on Excel & Financial Modeling

- Course Duration: 6 months

- Total Class: 36

- Class Duration: Daylong

- Class Time: 10:00am - 05:30pm

- Classes on: Every Friday.

- Starting From: 03 April, 2026

- Class Type: Online Live Class

| Installment | Amount |

|---|---|

| One time | 35,500 tk |

| Total | 35,500 tk |

| Installment | Amount |

|---|---|

| Registration Fee | 10,000 tk |

| 1st Installment | 7,500 tk |

| 2nd Installment | 7,000 tk |

| 3rd Installment | 7,000 tk |

| 4th Installment | 7,000 tk |

| Total | 38,500 tk |

Industry Expert Trainers

Masud Khan, FCA, FCMA

Chairman

UNILEVER Consumer Care LTD.

Nazmul Haider

Former Chief Financial Officer

Parfetti Van melle Mexico CEO, Plutus Consulting

Mohammad Refaul Karim Chowdhury (FCA, FFA, FIPA, FMVA, MCT)

DGM-Finance

Transcom Distributions Ltd.

Md. Abdullah Al Amin

Partner

Ahsan Manzur & Co.

Imrul Kayas, FCA, AFA(UK), MIPA (AUS)

Founder & Managing Partner

Imrul Kayas & Co.

Md Arifur Rahman

FCGA, AFA(UK), MIPA(AUS)

Founder & Chairman Corporate Academy

Don't lose this opportunity !!

If you want to make your future excellence, So you're in a right Place.

Regsiter nowWhy Professionals Choose Corporate Academy

At Corporate Academy for Professional Excellence (CAPE), we focus on building skilled professionals through practical, industry-driven training in VAT, Tax, Customs, and Accounting. Our programs are designed to bridge the gap between theory and real-world application, helping learners stay compliant, confident, and career-ready in a changing regulatory environment.

Industry-Focused Training

Job-oriented courses for VAT, Tax, Customs, and Accounting professionals.

Expert Trainers

Sessions by senior National Board of Revenue officials and industry professionals.

Career-Oriented Programs

Programs designed to boost skills and career growth.

Updated Curriculum

Latest VAT, Income Tax, and Customs laws covered.

To get the PGD certification (International Professional Accreditation Council- IPAC) after successful completion of the course.

Clarify Your Skills

Basic skills must be demonstrated for certification.

Notice Your Attendance

Minimum attendance is required to qualify.

"Join the mission.

Be part of something impactful."

Overview

What will you learn from this PGD Program?

Who Should Join This Program?

FAQ

Organizations We Work With