Post Graduate Diploma in

Practical Accounting & Financial Modeling

PGD-PAFM

Course Length

6 months

Class Duration

Daylong

Total Class

31

Starting From

30 Jan, 2026

Classes on

Friday

Class Time

10:00-01:00pm & 2:30-05:30pm

Class Type

Offline

Platform

Dhaka & Chittagong Campus

Introduction

35,000 Tk 38,500 Tk

Course Fee for ONETIME Payment

| Installment | Amount |

|---|---|

| Admission Fee | 10000 tk |

| 1st Installment | 10000 tk |

| 2nd Installment | 9500 tk |

| 3rd Installment | 9000 tk |

| Total | 38,500 tk |

| Installment | Amount |

|---|---|

| One time | 35,000 tk |

| Total | 35,000 tk |

Course Module

Key Highlight

- Accounting concept & framework Incl. IAS & IFRS.

- Accounting software-Tally (Step by step accounting transactions practical session).

- Analysis & reporting using advanced Excel to make yourwork life easy.

- Necessary excel formulas for accounts department & Different Financial Modelling.

- Preparation of Financial Statement and performance analysis for better business decisions.

- Financial statement analysis for VAT & Income tax professionals for NBR audit preparedness.

- Product Costing & pricing techniques, Landed cost and Inventory valuation.

Class 01: Understanding Basic Accounting Concepts

Class 02: Books of accounts, Bank Reconciliation and Journal Entries of Rectification of Error

Class 03: Accounting Standards- IAS & IFRS

Class 04: Preparation and Presentation of Financial Statement

Class 05: Cash flow statement (Direct & Indirect Method)

Class 06: Cost Accounting: (IAS 2) Measurement of Inventory, Inventory Valuation, write off, disclosure in FS, Landed cost & other cost analysis

Class 07: Cost Accounting: practical demonstration of product costing & pricing techniques, value chain analysis (How to calculate net realization value)

Class 08: Property, plant and Measurement as per IAS-16

Class 09: Revenue recognition & Lease accounting

Class 10: Accounting Terminologies for business performance analysis

Class 11: Current Tax & deferred Tax calculation & presentation in FS

Class 12: Review on Accounting cycle completion in a company

Class 13: Management Information System (Incl. BEP, EBITDA, NPAT, costing & necessary ratios for better business decision)

- Exam: Exam on practical accounting & finance operations

- Class 01: Accounting Software-How It Works?

a. Setup

b. Transaction/Posting

c. Reporting

(Tools: 1. Tally, 2. QuickBooks 3. miSoftware)

- Class 02: Tally Software:

1. Chart of accounts & mapping of transactions

2. Purchase & Payable Management

(Incl. PO, GRN, Invoice, TDS & VDS, payments process)

3. Sales & Receivable Management

(Incl. Sales order, Delivery challan, Sales Invoice, Sales collection)

- Class 03: Tally Software:

1. General Ledger: Ledger concept, Provision journal, Payable journal, standard journal

2. Financial Statement: Trial Balance, Financial Statemen, P&L, Equity

- Class 04: Misoftware

1. Chart of accounts & mapping of transactions

2. General accounting

3. Industries Specific Accounting (Trading, Hospital, NGO, Service, Manufacturing)

4. Purchase Process (Requestion to Pay)

- Class 05: Misoftware

1. General Ledger, Management Reporting, miOffice-HR & Payroll

2. Financial Statement: Trial Balance, Financial Statemen, P&L, Equity

- Class 06: QuickBooks Software

1. Software Overview

- Class 07: Financial Statements Preparation from accounting Software

1. Notes to the accounts

2. Trail Balance Export from Software

Exam on practical demonstration of Accounting Software

Class 01: Financial statement analysis for Income tax audit by NBR, preparedness & documents keeping for smooth audit Incl. TDS

Class 02: Input-out co-efficient preparation in excel with overhead allocation (Value addition)

Class 03: Financial statement analysis to face VAT audit conducted by NBR. Revenue recon with FS & VAT return, VDS analysis & keep documents ready for smooth audit.

Class 01: Advanced Formulas and Skills Required for Financial Modeling

Class 02: Financial Modeling Best Practice

Class 03: Building Multi Sheet Three Statement Model

Class 04: Building Single Sheet Three Statement Model

Class 05: Business Valuation & Discounted Cash Flow Model

Class 06: Scenario and Sensitivity Analysis

Class 07: Data Visualization

Class 08: Master Budget, Operational model, and Feasibility Report

- Exam

Exam on Excel & Financial Modeling

In today’s fast-paced business environment, proficiency in accounting and financial modeling is not just an asset; it’s a necessity. This comprehensive course is designed to bridge the gap between theoretical knowledge and real-world application, equipping you with the skills to navigate the complex world of finance with confidence.

Whether you’re a budding accountant, a finance professional, or a business owner, this course will empower you with a profound understanding of accounting principles and the prowess to perform robust financial analyses. Through a combination of expert instruction, hands-on practice with leading software like Tally, and advanced Excel techniques, you will emerge as a competent professional capable of making informed financial decisions and driving business success.

Prepare to dive into the core of accounting concepts and frameworks, including IAS and IFRS, and sharpen your skills in financial statement preparation and analysis. You’ll also master financial modeling, a critical tool for forecasting and strategic planning, all while ensuring compliance and preparedness for audits under NBR guidelines.

Join us in “Practical Accounting & Financial Modeling”

And start your journey towards becoming a key player in the financial landscape, adept at turning challenges into opportunities.

- Accounting concept & framework Incl. IAS & IFRS.

- Accounting software-Tally (Step by step accounting transactions practical session).

- Analysis & reporting using advanced Excel to make your work life easy.

- Necessary excel formulas for accounts department

& Different Financial Modelling. - Preparation of Financial Statement and performance analysis for better business decisions.

- Financial statement analysis for VAT & Income tax

professionals for NBR audit preparedness. - Product Costing & pricing techniques, Landed cost and

Inventory valuation.

This Post Graduate Diploma in Practical Accounting & Financial Modelling (PGD-PAFM) is ideal for:

Fresh Graduates & Job Seekers – who want to build strong practical skills in accounting, Excel, and financial modeling to increase employability.

Accounts & Finance Professionals – who wish to sharpen their knowledge of IAS, IFRS, Tally, QuickBooks, and advanced financial analysis for career growth.

VAT & Income Tax Practitioners (VC/ITP) – preparing for NBR audits, compliance, and certification exams.

Corporate Professionals & Managers – from non-finance backgrounds, who want to understand financial statements, costing, and decision-making tools.

Business Owners & Entrepreneurs – who want to manage their company’s accounts, taxation, and financial planning more effectively.

Students of Professional Bodies (ICAB, ICMAB, ACCA, CIMA, ICSB, etc.) – looking to gain practical exposure and enhance career opportunities.

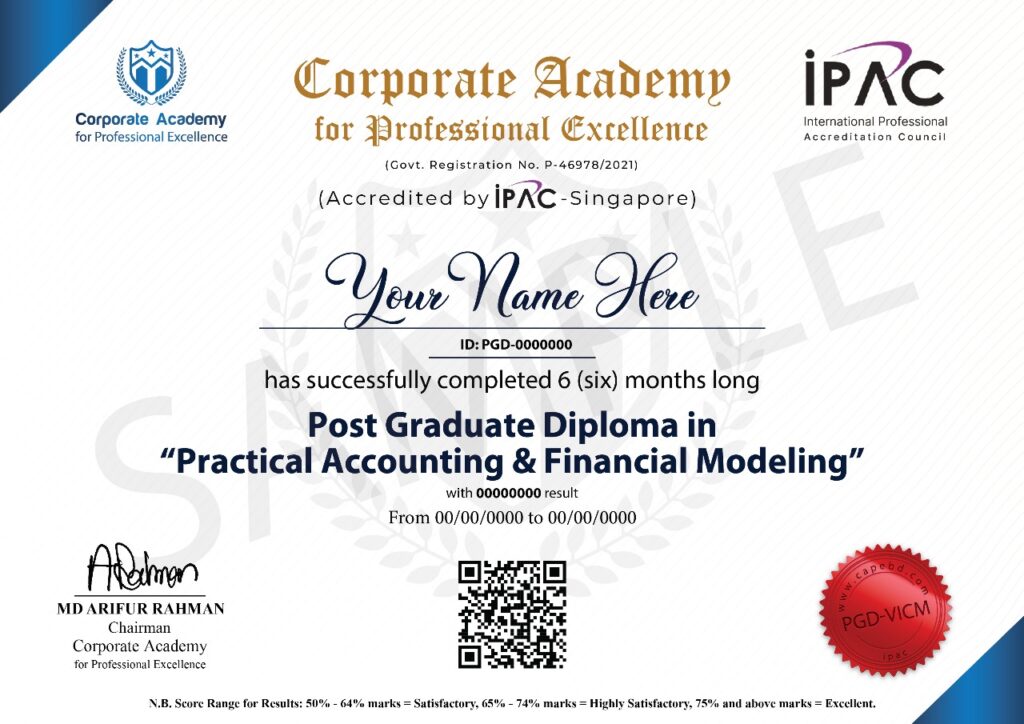

- After successfull completion of this PGD Program, you will get a certificate.

FAQ

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

What Our Participants are Saying

I express my deep gratitude to Mr. Md. Arifur Rahman FCGA, Founder & CEO of the Corporate Academy for Professional Excellence (CAPE), for his visionary leadership in launching the VICM program in Bangladesh. His initiative has provided an extraordinary platform for preparing students and professionals for meaningful employment and sustainable career advancement. I also extend my heartfelt appreciation to the distinguished senior officials of the National Board of Revenue and the former Commissioners of the Customs, Excise & VAT Commissionerate, whose invaluable sessions and practical insights have greatly enriched my learning and professional development. My deepest thanks also go to the dedicated faculty members and support staff of CAPE, whose tireless efforts, guidance, and encouragement have ensured the smooth conduct of this program. Their behind-the-scenes contributions have been instrumental in shaping the success of our 204-day journey of knowledge, skills, and professional growth.

Director, Consulting Services & Capacity Building

Hossain Mumlook & Co., Chartered Accountants

I had the privilege of attending the comprehensive Tax, VAT, and Customs training program conducted by Corporate Academy as part of the PGD-VICM 107 batch, and I can confidently say it was a truly transformative experience. The sessions were thoughtfully structured, seamlessly blending theoretical foundations with practical insights delivered by esteemed officials from the NBR, along with experienced professionals from renowned CA firms, companies, and industry experts—making the content highly relevant to real-world applications. The trainers exhibited profound expertise and genuine passion for the subject matter, breaking down complex regulations and procedures into easily understandable concepts. Their interactive teaching style fostered active engagement, creating an environment that was both dynamic and effective for learning. Beyond acquiring knowledge, the program also provided invaluable opportunities to build meaningful connections with professionals, experts, and officials in the field. I sincerely thank Corporate Academy for this outstanding initiative that not only spreads critical knowledge but also contributes to developing skilled experts in Tax, VAT, and Customs—an essential driver for compliance and business growth in our nation. I highly recommend Corporate Academy to any professional seeking to advance their expertise and stay ahead in the ever-evolving regulatory landscape.

Corporate Tax Manage

British American Tobacco Bangladesh Company Limited

The CAPE training of Post Graduate Diploma in VAT, Income Tax & Customs Management (PGD-VICM) Management (PGD in VICM) is a career-focused, value-demanding & practical-oriented professional diploma. It is a unique chance to get local expertise with international certification and take the unique opportunity to add value to our business, career & practice with the latest changes in Income Tax, VAT & Customs laws. NBR high officials along with other industry experts & respective qualified professionals conducted such lawful exclusive training sessions. Sincere thanks to the Corporate Academy Management, Executives, and Support Staff for their invaluable support and cooperation in making the entire program a smooth and successful experience. Best wishes for the Corporate Academy for Professional Excellence.

Assistant General Manager (AGM)

PKSF

I had the honor of completing the Post Graduate Diploma in VAT, Income Tax & Customs Management (PGD-VICM) under Corporate Academy, and it was an exceptionally rewarding experience. The program was meticulously designed, offering a balanced mix of in-depth theoretical knowledge and practical applications. Sessions were conducted by distinguished NBR officials, highly experienced CA, ICMA professionals and respected industry experts, ensuring that the learning remained current and directly applicable to real-life professional scenarios. The trainers demonstrated remarkable expertise and an engaging teaching style, simplifying complex regulations and making them accessible and easy to grasp. Their ability to connect technical knowledge with practical cases greatly enhanced my understanding and confidence in handling tax, VAT, and customs matters. Beyond knowledge, the program created a valuable platform to connect and exchange ideas with peers, experts, and policymakers an opportunity that significantly broadened my professional perspective. I sincerely commend Corporate Academy for offering such a transformative program that not only strengthens compliance knowledge but also fosters the development of skilled professionals critical for the nation’s business and economic growth. I wholeheartedly recommend this program to any professional who wishes to stay ahead in the dynamic field of taxation, VAT, and customs management.

Head of Finance, Accounts & Company Secretary.

Hilti Bangladesh.

I had the privilege of completing the PGD-VICM Program with Corporate Academy, where I was honored to be the topper of the course from 08 Batch. The program was structured with precision, combining comprehensive study materials, case-based learning, and practical applications of TAX, VAT & Customs regulations in Bangladesh. The instructors demonstrated deep expertise and were always available to provide guidance, ensuring every concept was clearly understood. Their commitment to delivering updated, real-world knowledge made the sessions highly valuable for professional application. Earning the top position was a proud moment, but more importantly, the program enhanced my technical skills, strengthened my confidence in TAX-VAT compliance, and prepared me to apply best practices in my professional role. I highly recommend Corporate Academy to anyone seeking quality & professional development in taxation, vat & customs management through compliance.

Deputy General Manager, Accounts & Finance

MGH Group

The PGD-VICM program offered by Corporate Academy has been an excellent learning journey for me. The course content is highly practical and relevant to current professional needs. The faculty members are knowledgeable and supportive, ensuring that every participant gains meaningful insights. I sincerely appreciate Corporate Academy’s dedication to maintaining high standards of education and professional development.

To get the PGD certification after successful completion of the course.

Clarify Your Skills

Basic skills must be demonstrated for certification.

Notice Your Attendance

Minimum attendance is required to qualify.

Industry Expart Trainers

Masud Khan, FCA, FCMA

Chairman

UNILEVER Consumer Care LTD.

Nazmul Haider, FCMA

Former Chief Financial Officer

Parfetti Van melle Mexico CEO, Plutus Consulting

Mohammad Refaul Karim Chowdhury (FCA, FFA, FIPA, FMVA, MCT)

DGM-Finance

Transcom Distributions Ltd.

Md. Abdullah Al Amin

Partner

Ahsan Manzur & Co.

Imrul Kayas, FCA, AFA(UK), MIPA (AUS)

Founder & Managing Partner

Imrul Kayas & Co.

Md Arifur Rahman

FCGA, AFA(UK), MIPA(AUS)

Founder & Chairman Corporate Academy

Organizations We Work With