Professional Certificate Course in

VAT MANAGEMENT

With Renowned Faclilitators

From National Board of Revenue (NBR)

Course Length

2 months

Class Duration

2.5 hours

Total Class

8 session

Starting From

20 Nov, 2025

Classes on

Friday & Saturday

Class Time

08:00 - 10:30pm

Class Type

Online

Platform

Zoom

Course Module

Topics at a glance:

1: Brief History of Value Added Tax System.

2: Value Addition & Value Added Tax (VAT).

3: VAT & Supplementary Duty Act-2012 & Rule-2016.

4: Schedules of VAT & SD ACT- 2012.

5: VAT, SD, Turnover Tax (TT) & Advance Tax (AT) & it’s Rates.

6: Important Definitions Under VAT & SD Act.

7: Statutory Regulatory Order (SRO)/General Order/Special Order.

8: Excise Duty and Surcharge, It’s Rates, Imposition & Calculation

Topics at a glance:

1: VAT Registration & Turnover Tax Enlistment (Mushak-2.1).

2: Threshold & Registration Threshold. Mandatory, Voluntary & Force Registration.

3: Central VAT Registration, It’s Procedure, Terms & Conditions.

4: Unit Registration & Registration Procedure.

5: Amendment, De-registration & Cancellation of Registration.

6: Special Provision for Registration & Use of VAT Registration.

7: Registration Related SRO, Order & Explanation.

Topics at a glance:

1: Accounting and Business Accounting.

2: VAT Accounting and It’s Importance.

3: VAT Accounting Related Act-Rule, Records & Documents.

4: Importance of Record-Keeping in VAT System.

5: Credit Note & Debit Note (Musak 6.7 & 6.8).

6: Accounting Related Register (Musak 6.1, 6.2, 6.2.1, 6.10).

7: Accounting Related Invoice (Musak 6.3, 6.4, 6.5, 6.6, 6.9).

8: Documents Required for Manufacturer, Trader/Commercial Importer.

Topics at a glance:

1: Input, Output and Unit Cost. Input-Output Coefficient & It’s Importance.

2: Preparation of Input-Output Coefficient (Musak 4.3) for Manufacturer.

3: Preparation of Input-Output Coefficient (Musak 4.3) for Trader.

4: Fair Market Price and Value of Supply.

5: When and Why Fair Market Price Determination Required.

6: Methods for Determination of Fair Market Price.

7: Fair Market Price Rules 2019.

Topics at a glance:

1: Input, Input-Tax, Input Tax Credit (Rebate) & it’s Mechanism.

2: Legal Provisions for Input Tax Credit. Terms and Conditions for Input Tax

Credit.

3: Partial Input Tax Credit & Calculation Method.

4: No Cascading Effect When Rebate Allowed.

5: Documents Required for VAT Rebate.

6: Difference Between Rebate, Refund & Drawback.

7: Penalty for Irregularities in Input Tax Credit (Rebate)System.

Topics at a glance:

1: VAT Deduction at Source (VDS) and It’s Importance.

2: Legal Provision and Related Rules for VDS.

3: Product & Services Under VAT Deduction.

4: Deducting Authority, Supplier & Their Responsibility.

5: Procurement Provider Under VDS, Time of Deduction & Payment

Procedure.

6: Adjustment by Deducting Authority & Supplier.

7: Penal Provision for Non-compliance of VDS.

Topics at a glance:

1: Offences Under VAT Act and Rule.

2: Penalty for Offences Under VAT Act and Rule.

3: Case filing, Investigation and Charge sheet Submission.

4: Trial By Judicial Magistrate for Offences and Appeal.

5: Alternative Dispute Resolution (ADR).

6: Procedure of Alternative Dispute Resolution.

7: Determination of Arrear under VAT Act and Rule.

8: Arrear Collection Procedure (VAT Demand).

VAT-TT Return (9.1, 9.2, 9.3, 9.4) Preparation and Submission.

1: Return, VAT & Turnover Tax Return & It’s Importance.

2: Fill-up and Submission of VAT-TT Return (Musak 9.1/9.2).

3: Late Submission and Amendment of Return (Musak 9.3/9.4).

4: Supply, Purchase, Import, Export and Their Entry in Return.

5: Adjustment (Increasing and Decreasing) in Return.

6: Different Sub Forms and Their Utilization.

7: Negative Balance in Return, It’s Carry Forward & Adjustment.

8: Case Study (VAT/TT Return Preparation)

1: Set off and carry forward of losses

2: Types of Returns of Income

3: Assessment Procedure

4: Self-Assessment

5: Normal Assessment

6: Assessment of Concealment

7: Discussion on Different Types of Assessment.

1: Appeal (Sec: 285-308)

2: Tribunal

3: Reference at High Court Division

4: Alternative Dispute Desolution, ADR

In today’s regulatory and business environment, a strong understanding of VAT and income tax laws is critical for businesses, professionals, and individuals looking to ensure compliance and optimize nancial operations.

This 2-month, 12-session certifcate course is carefully designed to equip participants with the complete work ow of VAT & Tax management in Bangladesh, directly guided by senior o cials from the NBR.

Whether you’re a nance professional, entrepreneur, or VAT/Tax Professional, this course will empower you with practical skills and insights to handle VAT & Tax matters e ciently and condently.

You will gain complete practical knowledge of VAT management in Bangladesh, guided directly by experienced officials from the National Board of Revenue (NBR).

Key learning outcomes include:VAT System Overview: Structure, legal framework, supplementary duties, turnover and advance tax, and related definitions.

VAT Registration: Eligibility, process, amendment, and cancellation procedures (Mushak-2.1).

VAT Accounting: Maintaining VAT books, registers, and invoices (Musak 6.1–6.10).

Input-Output Coefficient & Fair Market Price: Preparation of Musak 4.3 and price determination under Fair Market Price Rules 2019.

VAT Rebate & Refund: Input tax credit system, legal conditions, calculation, and refund procedures.

VAT Deduction at Source (VDS): Legal provisions, deduction process, responsibilities, and adjustments.

Offences & ADR: VAT offences, penalties, trial process, and alternative dispute resolution (ADR).

VAT Return Submission: Practical guidance on preparing and submitting Musak 9.1–9.4 returns with real-life case studies.

This course is ideal for:

Finance and accounting professionals involved in VAT compliance and reporting.

Entrepreneurs and business owners managing VAT operations or business accounts.

Students and fresh graduates in accounting, finance, or business fields seeking career opportunities in taxation.

Tax practitioners and consultants looking to enhance their knowledge of VAT laws and practices.

Corporate employees in finance, audit, or procurement departments who handle VAT-related activities.

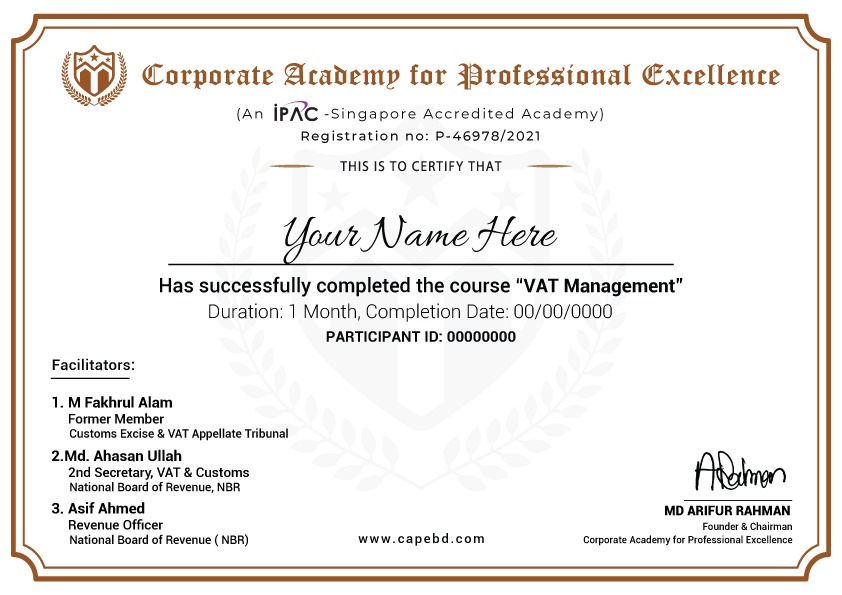

- After successfull completion of this course, you will get a certificate.

FAQ

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast

To get the PGD certification after successful completion of the course.

Clarify Your Skills

Basic skills must be demonstrated for certification.

Notice Your Attendance

Minimum attendance is required to qualify.

Industry Expart Trainers

Mohammad Fakhrul Alam

Former Member (Technical)

Customs Exise & VAT

Appellate Tribunal, IRD

Md Ahasan Ullah Tarun

Second Secretary

VAT & Customs National Board of Revenue (NBR)

Asif Ahmmed

Revenue Officer

National Board of Revenue (NBR)

Organizations We Work With