To make the govt. revenue generation smooth NBR certifies individuals officially to act like Income Tax lawyer which is ITP. After every five (5) years the exam is held that creates a big opportunity to build a career in the field of Income Tax.

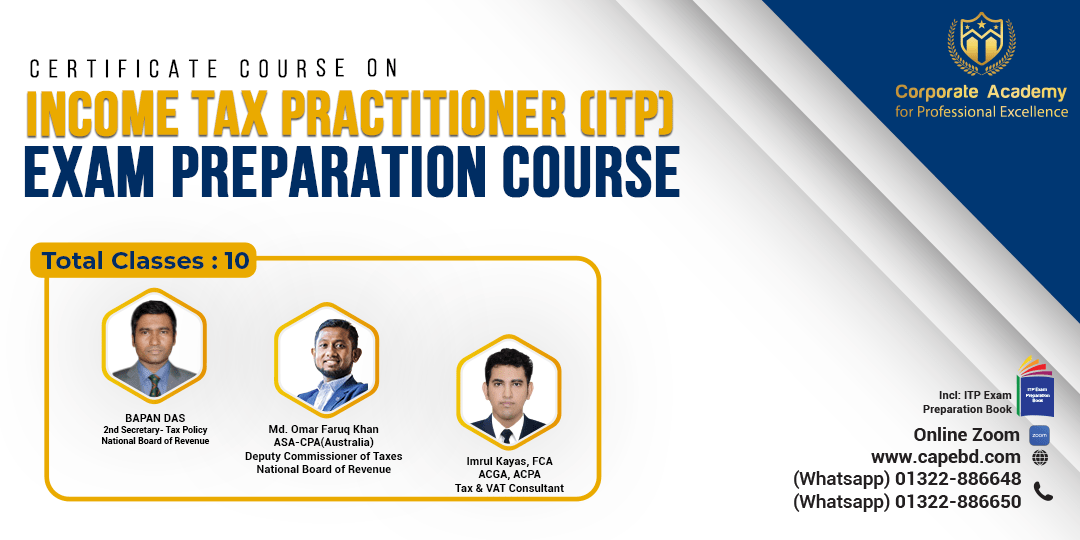

Corporate Academy, with the guidance of certified ITP practitioners, designed a unique course that will enable an eligible person to get this prestigious certificate.

Eligibility for this exam is as below:

* Graduate in Accounting, Management, Marketing, Finance, BBA & MBA, or

* Graduate in tax, or

* Graduate in law from any recognized university home or abroad, or

* Degree in higher auditing in banking, or

* Diploma in taxation, or

* Any degree in banking with higher auditing subject or related subject.

জাতীয় রাজস্ব বোর্ড কর্তৃক ইস্যুকৃত পেশাদারী সনদ ITP পরীক্ষায় অংশগ্রহণের যোগ্যতাঃ

দেশে-বিদেশে যে কোন স্বীকৃত বিশ্ববিদ্যালয় হতে

* আইন বিষয়ে ডিগ্রী অথবা

* কর বিষয়ে ডিগ্রী অথবা

* হিসাববিজ্ঞান বিষয়সহ বাণিজ্যে (Accounting, Management, Marketing and Finance, BBA & MBA) ডিগ্রি, অথবা

* উচ্চতর অডিটিং সহ ব্যাংকিং বিষয়ক অথবা

* ডিপোমা ইন সহ ট্যাকসেশন যেকোন বিষয়ে ডিগ্রী অথবা

* উচ্চতর অডিটিং ব্যাংকিং ডিপোমা এবং তৎসহ যেকোনো বিষয়ে ডিগ্রী

লিখিত পরীক্ষায় সিলেবাস :

(ক) আয়কর অধ্যাদেশ, ১৯৮৪

(খ) আয়কর বিধিমালা ১৯৮৪

(গ) অর্থ আইন/ অধ্যাদেশ

(ঘ) দানকর আইন ১৯৯০

(চ) হিসাব বিজ্ঞান

(৫) আয়কর আইন, অধ্যাদেশ ও বিধির বাস্তব প্রয়োগ

Course Content

- Introduction of Income Tax Law.

- Salary Calculation.

- Income from Capital Gain.

- Calculation of Income from business and profession.

- Tax Deduction at Source (TDS) Procedure.

- Advance Tax Calculation.

- Return Submission & Assessment Procedures.

- Individual Tax Return Calculations and Assessment

- Basic Accounting & Preparation of Financial Statements.

- Penalty & Appeal Procedure.

Course Duration

- Total Class : 10

- Time: 7.30 PM - 10.00 PM (30 minute Q/A session)

- Class Duration : 2.5 Hrs

- Day : Friday and Saturday

Course Details

- Introduction

- Bangladesh Tax Structure

- Sources of Tax law and practice of Income Tax

- Income Tax Ordinance, 1984 and Income Tax Rules, 1984 at a glance

- Different classes of assesses

- Different Tax rates

- Income Tax Authority

- Basic discussion of Income Tax

- Some important definitions on Income Tax

- Income in the payroll sector

- Income from salary

- Income from interest on securities.

- Income from Agricultural

- Income from House Rent

- Income from Securities

- Assessment of Companies

- Corporate Tax Rate at a glance

- Case References (for allowable expenditure)

- Areas of CSR (Corporate Social Responsibility)

- Section 30 Deduction not admissible

- CAPITAL GAIN

- Basic principles of capital gain

- Computation of capital gain

- Tax-exempted capital gains

- Tax rate in respect of capital gain

- Income from other Sources:

- Deemed income under the different subsection of Section 19:

- Why TDS

- Area of TDS

- Reference sections and rules

- Rate of deduction/collection

- Name of the deducting/collecting authorities

- Time frame within which deducted tax is to be deposited

- Consequences of failure to deduct/collect/deposit

- Monthly TDS statement

- Submission of half-yearly TDS return

- Advance payment of Tax

- Computations of Advance Tax

- Installment of Advance Tax

- Estimate of Advance Tax

- Next procedure in case of Advance Tax installment failure.

- Return of Income

- Return of Withholding Tax

- Audit of the return of Withholding Tax

- Universal Self-Assessment

- Minimum Tax

- Spot Assessment

- Assessment after hearing

- Tax Etc. escaping Payment

- Calculation of Total Taxable Income

- Calculation of net tax liability

- Calculation of Actual Investment

- Calculation of rebate on investment allowance

- Accounting concepts

- Journal Entries

- Preparation of Trial Balance

- Statement of Financial Position, Statement of Profit and loss, and other comprehensive income

- Statement of changes in equity.

- Tax Holiday & Gift Tax

- Penalty & prosecution

- Appeal & Tribunal

- High Court Division & Revision

- Model Test 01

- Model Test 02

This Course Is Best For

✔Head of Sales ✔Import Export Executive, ✔Commercial Officer, ✔Executive director and CEO, ✔Production Officer, ✔CA & Law Firm, ✔Supply Chain Manager, ✔Supply Chain Executive, ✔Joint Director, ✔Logistics Manager, ✔Executive VAT, ✔Business Development Manager, ✔Finance Secretary, ✔Health and Safety Executive, ✔Head of Finance and Operations, ✔Business Owner, ✔Banker, ✔Advocate, ✔Income Tax Lawyer, ✔CA Students, ✔Business graduates, ✔LLB Students, ✔Deputy General Manager (DGM).

Benefits of this Program

- Learn the basics on Income Tax management

- Complete preparation for ITP certificates.

- Mock test with intensive support from the mentor.

- Necessary guidance to prepare better for the exam.